Finance, lease, or buyout? A calculator built for the way dealers pitch

Sep 11, 2025

I used to walk into a dealership, get a glossy sheet with a monthly payment and cash due today, and think, “Cool—this one’s cheaper.” Later I’d learn the tax was handled differently, a fee was buried, or my plan to keep the car for five years blew up the math. I built a calculator that lets you enter quotes exactly the way dealers present them and then compares the real economic cost—including what your car might be worth later (depreciation) and how long you plan to keep it (your horizon). Below I’ll show you how I think about it, then I’ll walk through a real set of results from the tool.

Try it yourself: fiscademy.com/calculator/car-quote-compare

What’s really going on (the simple map)

Think of this like a small business: cash in, cash out, and what you still own at the end.

| Piece | Plain-English meaning | Why it matters |

|---|---|---|

| DAS (cash due today) | Money you hand over now (down payment, first month, fees, tax) | Big up-front swing; easy place for quotes to look different |

| Monthly payment | What leaves your account each month | Can hide tax/fee handling if quotes aren’t aligned |

| Term | How long you pay (months) | Affects total paid and timing of equity |

| Residual / Buyout | Lease’s assumed end value or the price to purchase | Drives lease math and buyout feasibility |

| Exit value (depreciation) | What your car can likely sell for at your horizon | Offsets cost for owning paths (finance, lease→buyout) |

| Ending equity | Exit value minus what you still owe | What you keep at the end (your “give-back”) |

| Total cost (economic) | Total paid minus ending equity | The fairest way to compare options |

| Equivalent monthly | Total cost ÷ months | Side-by-side monthly apples-to-apples |

Quick screeners (so you don’t waste time)

Start with these rules before you even enter numbers.

| Rule | What it means | How I use it | Common fail |

|---|---|---|---|

| Match tax mode | Some leases tax the payment monthly; others tax a big amount upfront | Make sure both quotes use the same mode or rebuild one | Comparing “low payment” to “upfront-taxed” and thinking it’s cheaper |

| Treat DAS as real money | $0 DAS isn’t $0 cost | Always include DAS in totals | Getting seduced by “$0 down” |

| Compare at your horizon | If you’ll keep the car ~60 months, compare 60-month economics | Use “normalize to horizon” or compare natural endpoints carefully | Calling a 36-month lease “cheaper” than a 60-month loan |

| Own vs. not own | Finance/buyout builds equity; lease→return never does | Expect lease→return to look pricier per month | Ignoring the equity you’ll have later |

A worked example (with the real numbers)

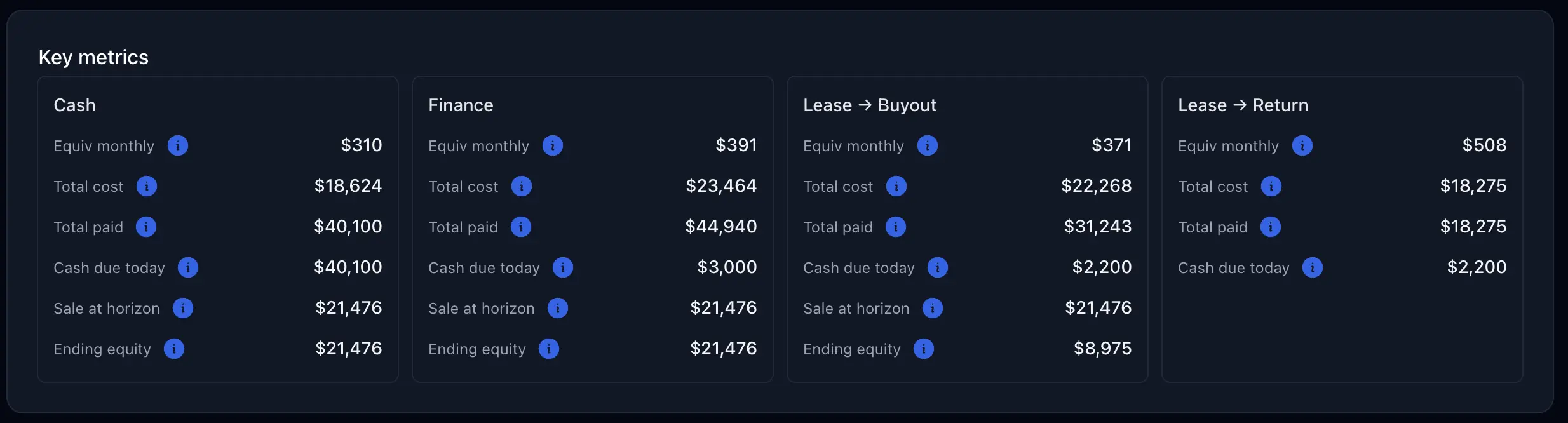

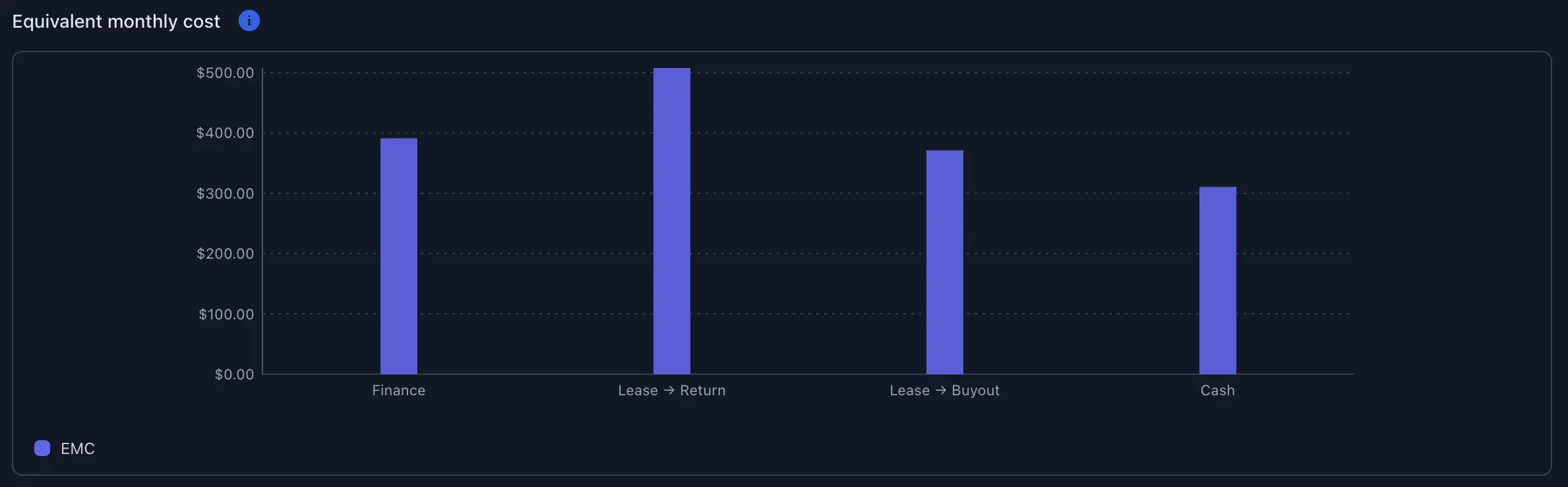

I ran four paths side-by-side and set the plan to a 60-month horizon. Depreciation (Auto) assumed a hybrid SUV sold via private sale at the end. Here are the results from the calculator:

| Scenario | Equivalent monthly | Total cost (economic) | Total paid | Cash due today | Sale at horizon | Ending equity |

|---|---|---|---|---|---|---|

| Cash | $310 | $18,624 | $40,100 | $40,100 | $21,476 | $21,476 |

| Finance | $391 | $23,464 | $44,940 | $3,000 | $21,476 | $21,476 |

| Lease → Buyout | $371 | $22,268 | $31,243 | $2,200 | $21,476 | $8,975 |

| Lease → Return (36 mo) | $508 | $18,275 | $18,275 | $2,200 | — | — |

What this tells us (in plain English):

- Cash is cheapest over five years, but only if you’re fine parting with ~$40k today.

- Lease → Buyout edges Finance on monthly cost in this run (~$20/mo cheaper) because the early lease payments are lower and the buyout APR/residual are decent. You own the car by your horizon, but you still owe some of the buyout loan—hence lower equity than Finance at month 60.

- Lease → Return is a good “I want to switch in ~36 months” option, but normalized per month it’s the priciest because you never build equity.

(Definitions you’ll see in the tool: Total cost = Total paid − Ending equity. Equivalent monthly = Total cost ÷ months.)

What actually moves the needle

Most decisions swing on these few inputs.

| Lever | Why it matters | Before → After | What I’d do |

|---|---|---|---|

| Your horizon | Owning longer spreads costs and builds equity | 36 → 60 months | Re-run at 36/48/60/72; watch equivalent monthly shift |

| Residual % / Buyout APR | Sets how attractive lease→buyout is vs finance | Residual 58%→62%, APR 6.5%→5.5% | Ask for the worksheet; negotiate APR/residual where possible |

| Exit value (market) | Hot market = higher resale | Exit −5% → EMC +≈ $18/mo (on a 60-mo plan) | Sense-check values; switch selling method if needed |

| Selling channel | Trade-in offers less than private sale | Private → Trade-in (−~8%) | If you have time, model private sale with a small listing cost |

| Lease tax mode | Upfront vs on-payment changes cash flow and totals | Upfront → Monthly-taxed | Align quotes to the same tax mode before comparing |

| DAS vs rolled-in | $0 DAS usually means higher monthly and more interest | $0 → $2,000 DAS | Don’t chase $0 down—compare total cost |

(Mini sensitivity shown above: a 5% drop in exit value on a ~$21.5k resale moves equivalent monthly by about $18 over 60 months.)

The simple alternative (side-by-side)

Most people “shop the monthly.” Here’s how that stacks up against a quote-native comparison.

| Dimension | “Monthly-only” shopping | Quote-native comparison (this tool) |

|---|---|---|

| Hassle | Low (fast but blind) | Slightly higher (enter a few numbers) |

| Taxes & fees | Often inconsistent across quotes | Normalized so it’s apples to apples |

| Horizon | Ignored | Central to the math |

| Equity / resale | Ignored | Included for owning paths |

| When it wins | Short trial, low commitment | Real purchase/lease decisions you won’t regret later |

When I pick A vs. B (rules I actually use):

- If I know I’ll swap cars at ~36 months and I want the lowest commitment, I’m fine with Lease → Return (but I still check tax mode and DAS).

- If I’ll likely own the car for 4–6 years, I compare Finance vs Lease → Buyout at my horizon.

- If the lease residual is strong and the buyout APR is fair, Lease → Buyout often beats straight Finance.

- If I’m short on cash but plan to keep the car, I compare Finance vs Lease → Buyout and look closely at the ending equity difference at my horizon.

- If quotes aren’t aligned (one taxes monthly, one taxes upfront), I rebuild one in Components so I’m not fooling myself.

Glossary (no jargon left behind)

| Term | Simple definition | Why it matters |

|---|---|---|

| DAS | What you pay the day you sign | It’s real money—don’t ignore it |

| MSRP | Window-sticker price | Many residuals are a % of this |

| Residual | Lease’s end value assumption | Drives lease payment & buyout math |

| Money Factor (MF) | Lease’s interest rate (×2400 ≈ APR) | Determines rent charge on leases |

| APR | Loan interest rate | Determines finance cost on loans |

| Cap Cost / Adjusted Cap | Lease price before/after rolled items | Starting point for lease math |

| Disposition fee | Fee when you return a lease | Add it to lease→return totals |

| Exit value | Estimated sale price at your horizon | Offsets costs for owning paths |

| Ending equity | Exit value − remaining payoff | What you keep at the end |

| Equivalent monthly | Total cost ÷ months | Clean comparison across options |

Checklist (do this next)

- Decide your horizon (36/48/60/72).

- Grab your quotes. Write down monthly, term, DAS, and whether tax is included.

- If you have a lease worksheet, note residual % and money factor.

- Open the calculator and enter each quote in Simple mode first.

- If tax modes differ, rebuild a scenario in Components so they match.

- Turn on Depreciation → Auto; set powertrain, body style, and selling method.

- Compare Equivalent monthly and Ending equity at your horizon.

- Nudge one lever at a time (residual, APR, exit value, DAS) and see what actually changes the answer.

- Make the call you can defend with numbers—not vibes.

CTA: Plug your own numbers into the calculator: fiscademy.com/calculator/car-quote-compare.

(I’m not your tax advisor; state rules vary. If something’s unclear, ask your dealer to show the worksheet and tax mode.)